LONDON, Sept. 23, 2025 (GLOBE NEWSWIRE) -- The ranks of crypto millionaires have surged to an unprecedented 241,700 individuals worldwide, according to the newly released Crypto Wealth Report 2025 by international residence and citizenship advisory specialists Henley & Partners. That’s a remarkable 40% increase in just 12 months, fueled by a dramatic surge in Bitcoin millionaires — up 70% year-on-year to 145,100 holders — and a booming total market valuation of USD 3.3 trillion as of June 2025, a 45% jump from a year previously.

At the apex of the crypto wealth pyramid, the number of ultra-wealthy individuals is rising sharply: 450 centi-millionaires now control crypto portfolios worth USD 100 million or more, up 38% since last year, while the number of crypto billionaires has climbed to 36, an increase of 29%. This significant growth coincides with a watershed year for institutional adoption, highlighted by the first-ever cryptocurrencies launched by a sitting US President and First Lady.

Dominic Volek, Head of Private Clients at Henley & Partners, says the surge of crypto-wealth is forcing governments and wealth managers to confront a new reality. “Traditional finance assumes money has a home address — but cryptocurrency doesn’t. Geography is now optional. With just 12 memorized words, an individual can secure a billion dollars in Bitcoin, instantly accessible from Zurich or Zhengzhou alike.”

Wealth Without Borders

The shift towards Bitcoin as collateral rather than a speculative asset marks a critical evolution as Philipp A. Baumann, Founder of Z22 Technologies, points out in the report. “Bitcoin is becoming the foundation of a parallel financial system, where [it] is not merely an investment for speculation on fiat price appreciation, but the base currency for accumulating wealth.”

The philosophical implications of this shift are profound, according to Samson Mow, CEO of JAN3, illustrating the tension between traditional and digital money systems: “Over any long-time horizon, fiat currency has one destiny: infinity. Bitcoin, on the contrary, has the opposite: 21 million.” This fixed supply versus infinite expansion represents what Mow calls “the defining paradox of our age”, as governments grapple with a form of wealth that exists outside traditional monetary control.

The convergence of crypto wealth and global mobility is accelerating. Catherine Chen, Head of VIP & Institutional at Binance, observes that “this new, mobility-driven class of investors is increasingly turning to citizenship by investment programs as a strategic route to geographic and financial flexibility.”

Townsend Lansing, Head of Product at CoinShares, confirms the broader momentum: “Driven by favorable regulatory winds, institutional adoption has not only arrived — it is surging.” Dr. Guneet Kaur, senior editor at CCN.com agrees, adding that “CBDCs, digital forms of a nation’s legal tender, are being explored by over 100 economies, with 49 countries in the pilot stage as of July 2025. They promise cheaper and faster state-backed payments.”

Crypto-Friendly Jurisdictions

The Henley Crypto Adoption Index, a proprietary tool updated annually, benchmarks the world’s most crypto-friendly countries with investment migration programs. Drawing on more than 750 data points, it offers digital asset investors a clear overview of how these different jurisdictions with residence and citizenship by investment pathways are regulating and adopting cryptocurrency and blockchain.

The index evaluates 29 investment migration programs across six key parameters — Public Adoption, Infrastructure Adoption, Innovation and Technology, Regulatory Environment, Economic Factors, and Tax-Friendliness — enabling investors to identify jurisdictions that best match their priorities.

Singapore leads with exceptional scores across Infrastructure Adoption, Innovation and Technology, and Regulatory Environment. Hong Kong (SAR China) follows with robust Economic Factors and high Tax-Friendliness, while the USA boasts strong Public Adoption and Innovation and Technology metrics. Switzerland and the UAE round out the Top 5 performers, with the Emirates scoring a perfect 10 for Tax-Friendliness, with zero taxes on crypto trading, staking, and mining.

Malta and the UK also score highly overall, both offering sophisticated regulatory frameworks, while Canada, Thailand, and Australia complete the top tier with balanced strengths across multiple factors.

Luxembourg brings deep financial expertise to digital assets while Portugal rewards patient crypto investors — those holding over one year pay no capital gains tax. Austria applies securities tax frameworks to crypto, while Italy’s flat-tax regime for new residents includes foreign-sourced crypto gains. Monaco draws ultra-wealthy crypto holders with zero personal income tax.

St. Kitts and Nevis accepts cryptocurrency for citizenship applications, as does Antigua and Barbuda. Thailand recently announced a five-year capital gains exemption for crypto trading and Malaysia builds fintech capabilities through Digital Free Trade Zone initiatives. Mauritius, Costa Rica, El Salvador, Greece, Latvia, New Zealand, Panama, Türkiye, and Uruguay also have strategies to attract mobile digital asset investors.

Sarah Nicklin

sarah.nicklin@henleyglobal.com

+27 72 464 8965

随机文章

热门文章

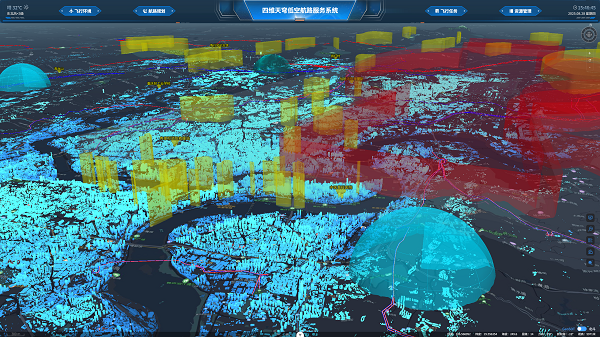

V1.0重磅发布!四维天穹绘构低空天路

Merck Appoints David Weinreich as New Global Head of R&D and Chief Medical Officer for Healthcar

“兴火·燎原”总冠军诞生,云宏信息《金融高算力轻量云平台》登顶

泳池过滤器怎么选?揭开Waternics水武仕珍珠岩过滤器的“硬核密码”!

Graco推出QUANTM电动双隔膜泵系列的改进产品

2025上海CMEF:鱼跃以“AI+医疗”开启健康管理新纪元

再获殊荣!itc分布式综合管理平台荣获2024年度“分布式处理十大品牌”

北京爱育华医院耳鼻喉头颈外科高品质服务升级

交个朋友严选背后:为何是蛰伏三年的酃酃酒