RIYADH, Saudi Arabia, Oct. 02, 2025 (GLOBE NEWSWIRE) -- The Capital Market Authority (CMA) called upon relevant and interested persons participating in the capital market to share their feedback on opening the Main Market to all categories of non-resident foreign investors and enabling them to directly invest in it. The consultation period will last for 30 calendar days, ending on 09/05/1447H, corresponding to 31/10/2025.

The draft aims to broaden and diversify the base of investors eligible to participate in the Main Market, while also attracting additional investments and increasing market liquidity.

If approved, the proposed draft will eliminate the concept of the Qualified Foreign Investor (QFI) in the Main Market, thereby allowing all categories of foreign investors to access the market without the need to meet qualification requirements. It will also abolish swap agreements, which were previously used as an option to allow non-resident foreign investors to obtain only the economic benefits of listed securities, and instead grant them the ability to directly invest in listed shares on the Main Market.

By the end of the second quarter of 2025, international investor ownership exceeded SAR 528 billion, while foreign investments in the Main Market reached around SAR 412 billion during the same period, representing a growth of 471% compared to SAR 72 billion at the end of 2015. The Draft is expected to further attract additional foreign investments.

It is worth noting that in July 2025, the CMA approved measures to simplify the procedures for opening and operating investment accounts for certain categories of investors. These included natural foreign investors residing in one of the Gulf Cooperation Council (GCC) countries, as well as those who had previously resided in the Kingdom or in any GCC country. This initiative aimed to strengthen confidence among participants in the Main Market and further support the local economy.

This draft aligns with the CMA's gradual approach to opening the market, building on previous phases and paving the way for complementary steps aimed at further liberalizing the capital market. The goal is to position it as an international marketplace capable of attracting greater flows of foreign capital.

The CMA emphasized that the comments of relevant and interested persons shall be taken into full consideration for the purpose of approving the final proposed amendments, which in turn shall contribute to the aim of enhancing and developing the regulatory environment.

Opinions and comments can be received through any of the following:

Prescribed form for providing comments

Contact Details:

Capital Market Authority

Communication & Investor Protection Division

+966114906009

+966557666932

Media@cma.org.sa

www.cma.org.sa

About CMA:

The Capital Market Authority (CMA) in Saudi Arabia unofficially started in the early fifties, and continued to operate successfully, until the government set its basic regulations in the eighties. The current Capital Market Law is promulgated and pursuant to Royal Decree No. (M/30) dated 2/6/1424H, which formally brought it into existence. The CMA is a government organization applying full financial, legal, and administrative independence, and has direct links with the Prime Minister.

For more information about CMA, please visit the official website: www.cma.org.sa

随机文章

热门文章

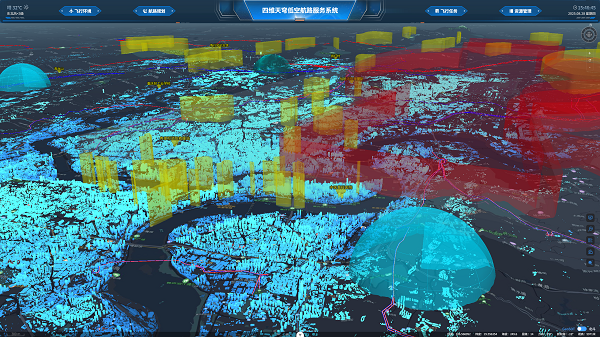

V1.0重磅发布!四维天穹绘构低空天路

Merck Appoints David Weinreich as New Global Head of R&D and Chief Medical Officer for Healthcar

“兴火·燎原”总冠军诞生,云宏信息《金融高算力轻量云平台》登顶

泳池过滤器怎么选?揭开Waternics水武仕珍珠岩过滤器的“硬核密码”!

Graco推出QUANTM电动双隔膜泵系列的改进产品

2025上海CMEF:鱼跃以“AI+医疗”开启健康管理新纪元

再获殊荣!itc分布式综合管理平台荣获2024年度“分布式处理十大品牌”

北京爱育华医院耳鼻喉头颈外科高品质服务升级

交个朋友严选背后:为何是蛰伏三年的酃酃酒